Home Prices Continue Gains in April According to the Spcaseshiller Home Price Indices

The monthly price change dipped in July, down by 0.3%, the first such decline since late 2018

The surge in mortgage rates has brought the housing market to an impasse. Many buyers moved to the sidelines as the cost of homeownership became prohibitively high, while sellers were unwilling to give up locked-in record-low interest rates and expectations of peak sales prices.

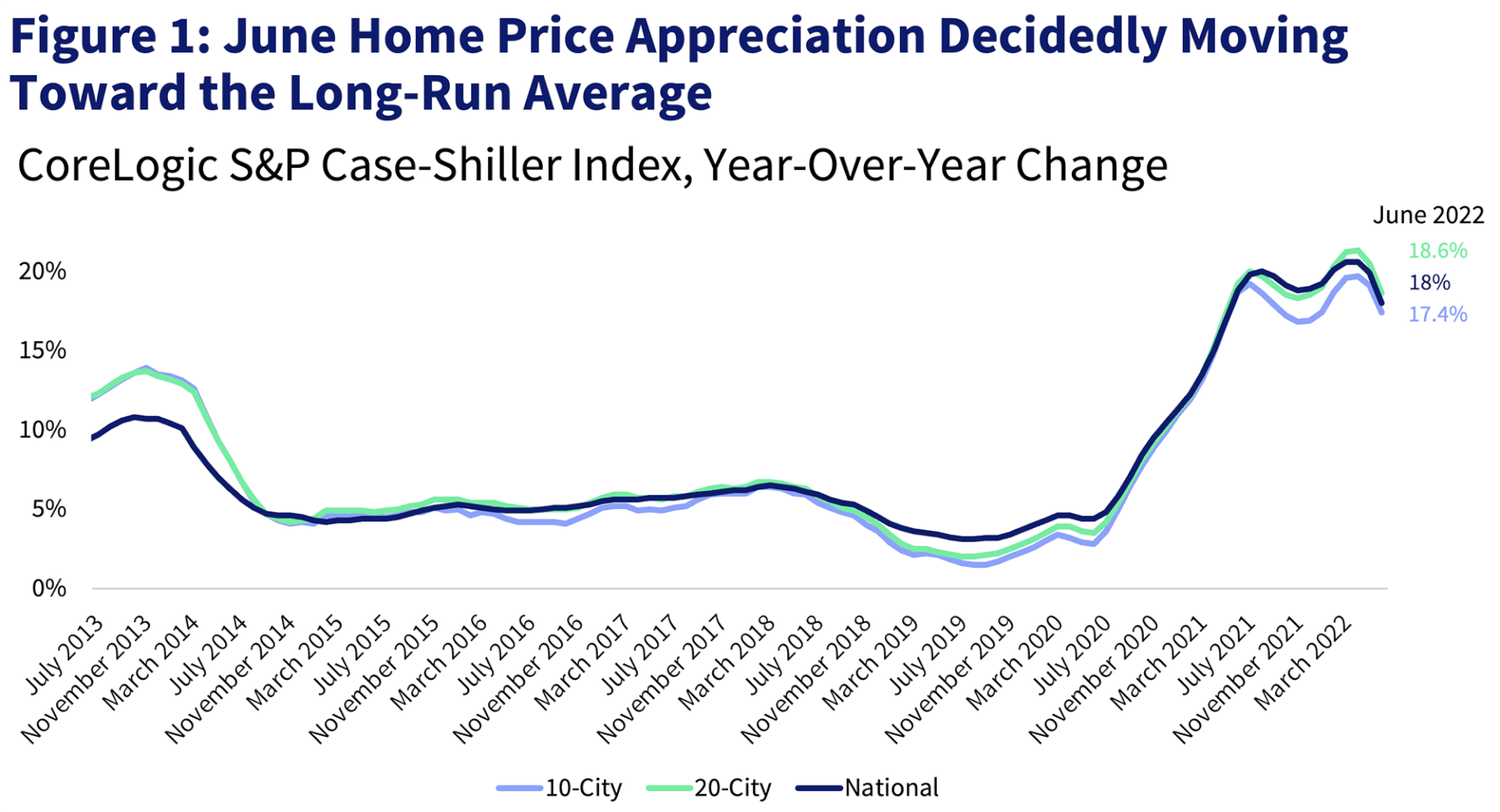

In July, the CoreLogic S&P Case-Shiller Index posted a 15.8% increase, down from an 18.1% gain in June, marking the fourth month of decelerating annual home price appreciation. Nevertheless, due to the price growth momentum over the last year, July's year-over-year increase was the second strongest since the beginning of the data series (Figure 1). At 19.9%, July 2021 had the highest growth recorded for that month.

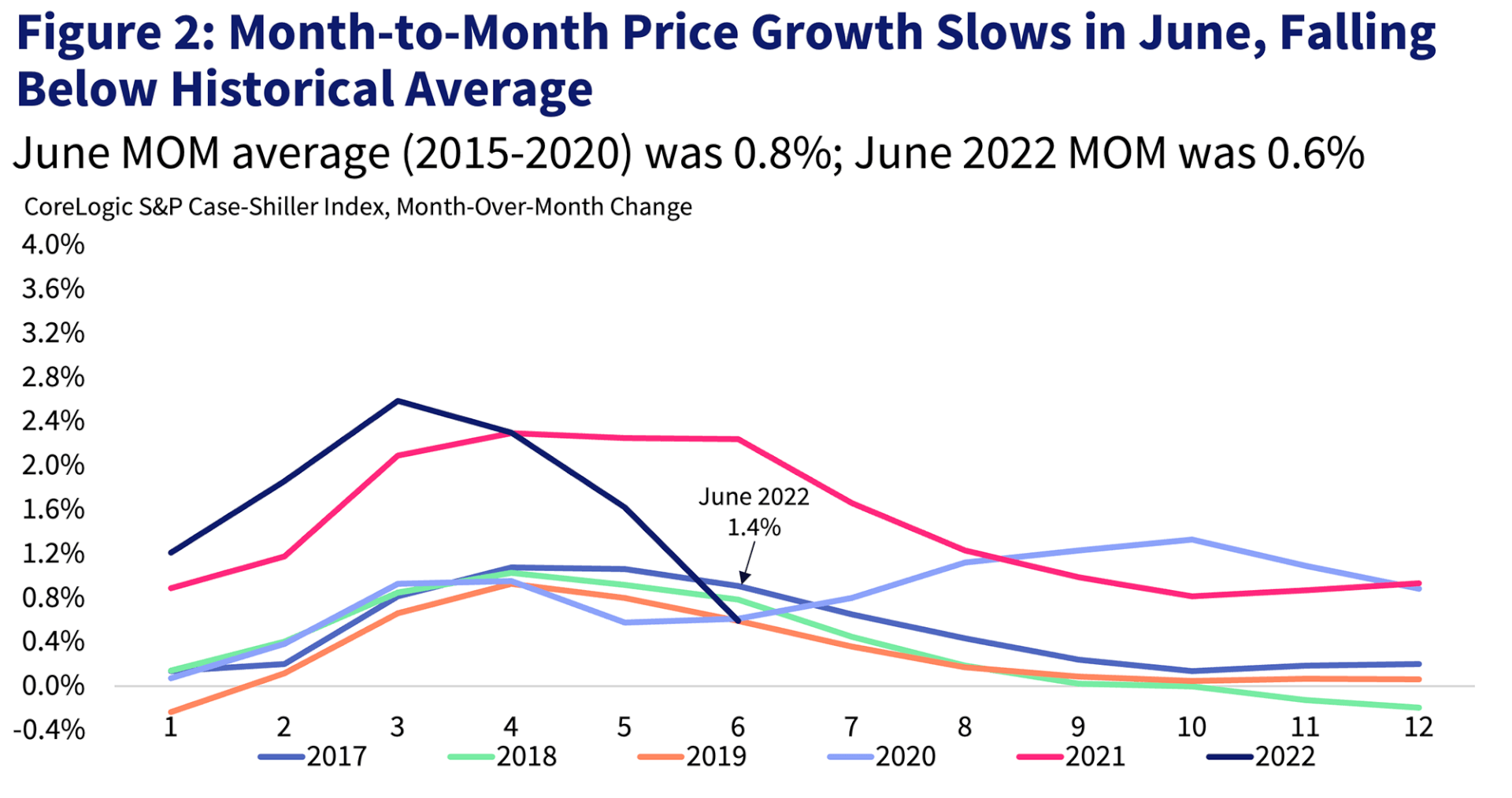

In addition, the non-seasonally adjusted month-to-month index turned negative, down by 0.3% in July from a 2.6% peak increase in March and a 0.6% gain in June, suggesting that home price growth will march at a much slower pace going forward. Between 2014 and 2019, the monthly index changes from June to July averaged about a 0.5% gain (Figure 2). The last time monthly price changes dropped was in the winter of 2018-2019, when the Federal Reserve went through a round of monetary tightening and the housing market similarly slowed.

At this pace, and according CoreLogic's Home Price Index forecast, annual home price growth is expected to slow to 10% by December, half of the peak 20% increase recorded in April 2022. Home price deceleration and seasonal declines in some markets will provide opportunities for potential buyers who are now facing less competition than earlier this year. Nevertheless, with mortgage rates currently above 6% and little signs of slowing, housing demand will suffer beyond what was initially expected earlier this year.

The 10- and 20-city composite indexes also showed signs of deceleration — up by 14.9% and 16.1% year over year, respectively — compared with 17.4% and 18.7% growth in June. That's a decline of about 2.5 and 2.6 percentage points, respectively, in just one month. And while the overall tendency for more price increases in smaller markets continues to drive the 20-city index growth higher, slowing price gains were slightly higher in 20-city index.

Compared with the 2006 peak, the 10-city composite price index is now 44% higher, while the 20-city composite is up by 53%. Adjusted for inflation, which continues to remain concerningly elevated, the 10-city index is now up by 1%, while the 20-city index is up by 7% compared with the 2006 peak.

Source: CoreLogic S&P Case-Shiller Indices, not seasonally adjusted (August 30, 2022, release)

© 2022 CoreLogic,Inc., All rights reserved.

Source: CoreLogic S&P Case-Shiller Indices, not seasonally adjusted (September 27, 2022, release)

© 2022 CoreLogic,Inc., All rights reserved.

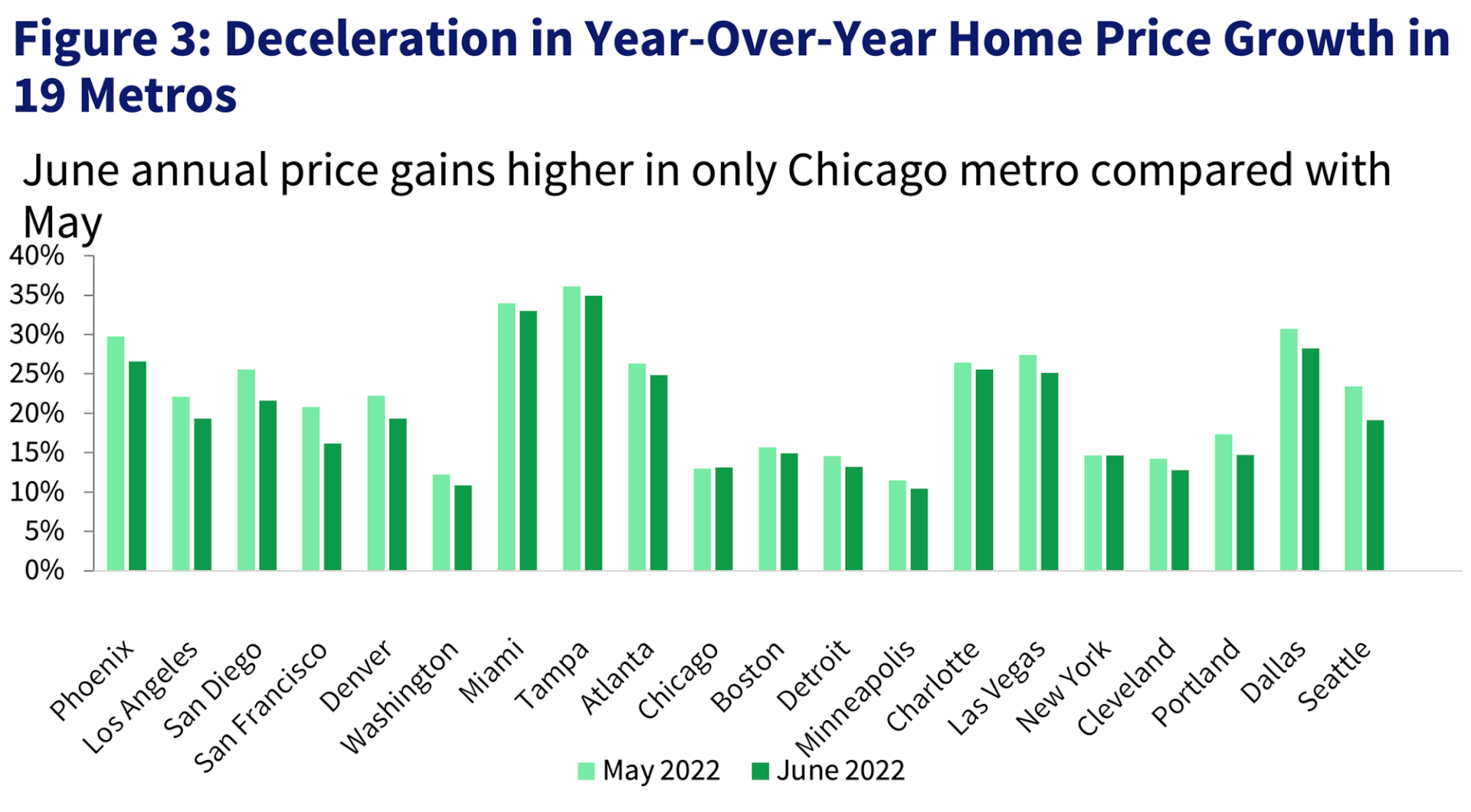

For the fifth straight month, Tampa, Florida posted the strongest annual home price growth among the 20 tracked markets, surging by 31.8% in July, down from June's non-seasonally adjusted rate of 35%.

Miami ranked second, recording a 31.7% year-over-year gain in July, down from 33% the month before. Dallas now ranks third, with a 24.7% increase in July, followed by Charlotte, North Carolina and Atlanta. Phoenix's rapidly slowing housing market pulled it to the sixth position with a 22.4% increase — down from February's 32.9% gain, when it last held the index's strongest price growth position.

All 20 metros experienced a deceleration in annual gains in July (Figure 3). San Francisco, San Diego, Seattle and Phoenix posted the largest slowdowns in annual gains compared with June — all down about 4 to 5 percentage points in one month. Cleveland and Chicago posted smallest declines in annual gains compared with June.

Minneapolis and Washington continued to post the slowest increases in year-over-year gains, a respective 9% and 9.4%.

Source: CoreLogic S&P Case-Shiller Indices, not seasonally adjusted (September 27, 2022, release)

© 2022 CoreLogic,Inc., All rights reserved.

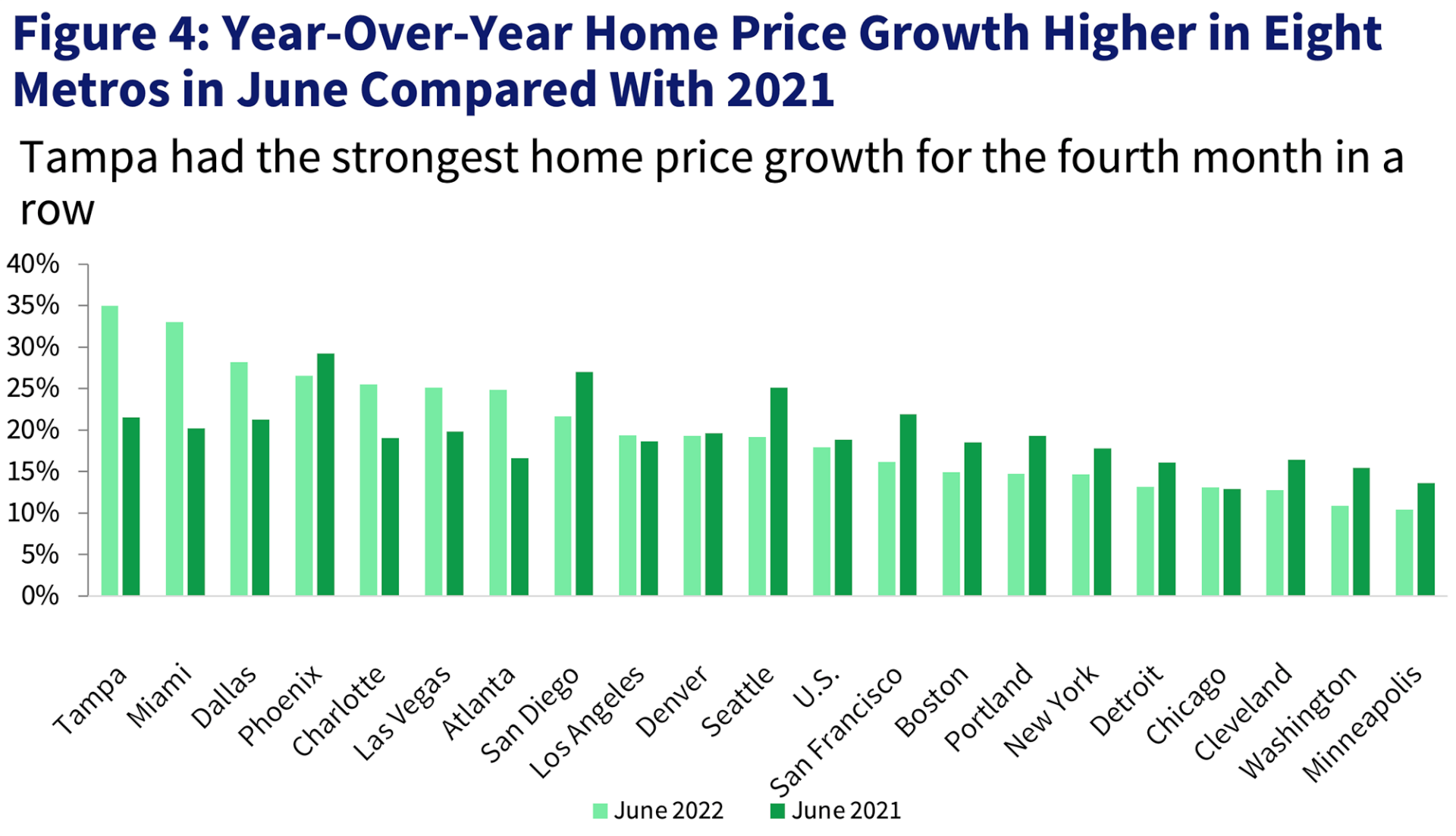

Compared with annual gains recorded last July, five metros continued to see stronger increases — the same five that posted the highest annual growth this July. Again, the same West Coast cities posted the largest slowdown in gains compared with last July as last month. San Diego showed the largest decline, down by 11.2 percentage points, followed by San Francisco (down by 11.1 percentage points) and Seattle (down by 11 percentage points).

On the other hand, Miami and Tampa were up by as much as 7 to 9 percentage points in just one year (Figure 4).

Source: CoreLogic S&P Case-Shiller Indices, not seasonally adjusted (September 27, 2022, release)

© 2022 CoreLogic,Inc., All rights reserved.

Furthermore, all three price tiers also posted slower annual gains. The low-price tier was up by 17.1% in July, while the middle tier slowed to 16% and the high tier was up by 17.6%. The high tier showed the largest deceleration in annual gains compared with June, down by 3.1 percentage points, even though it is still averaging a higher rate of growth compared with more affordable tiers. Relatively smaller deceleration in the low tier could reflect continued pressure from multiple buyers, including first-time buyers and investors, who remain present in some markets despite the surge in mortgage rates. According to CoreLogic's latest investor data, investor activity remained steady in the summer of 2022, leading to an increased share of purchases by these buyers while overall sales declined. Investors of all sizes continue to purchase about 100,000 properties per month nationally.

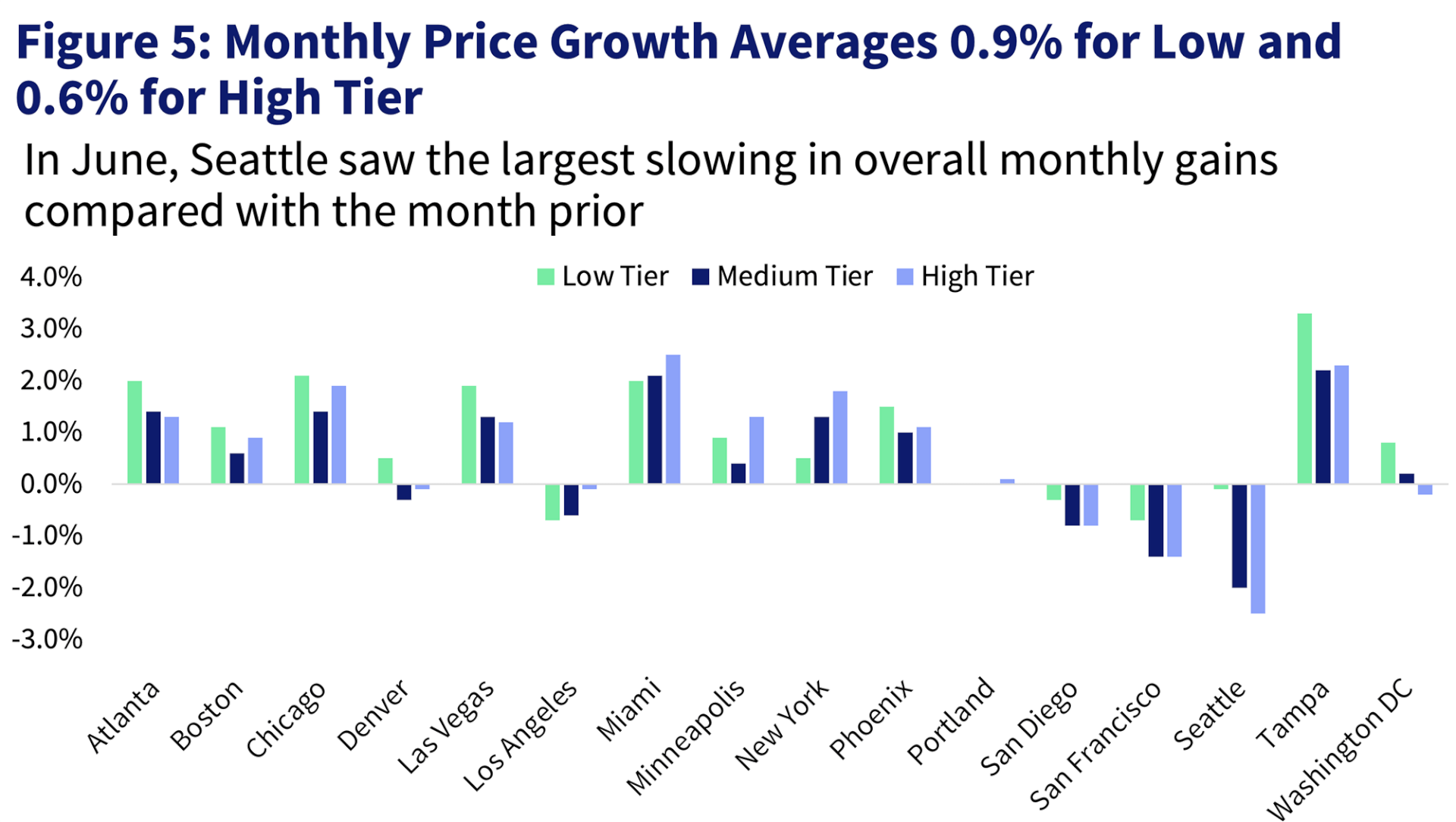

The month-over-month comparison of appreciation by price tier and location also reveals relative changes in demand across the country. From June to July, the pricier Western metros — particularly San Francisco; Seattle; San Diego; Los Angeles; Portland, Oregon and Denver — showed declines in monthly gains across price tiers. In fact, July was the second month of monthly declines in a number of metros. Again, July has historically seen an increase in monthly home price gains compared with June. The largest monthly increases were in the South, including Miami and Tampa, where prices were up notably in July.

The average monthly price gain among low-tier homes was down by 0.1% in July, though that number is not seasonally adjusted. The high-tier monthly declined 0.9% on average, while middle-tier monthly price declines averaged 0.7% (Figure 5).

Source: CoreLogic S&P Case-Shiller Indices, not seasonally adjusted (September 27, 2022, release)

© 2022 CoreLogic,Inc., All rights reserved.

As housing demand continues to cool and both buyers and sellers try to find their footing, it is important to keep in mind that the rush in housing demand in 2021 was fueled by unusual developments, such as COVID 19-induced demand for more space and for vacation homes, as well as record-low mortgage rates. The road toward a healthier housing market will be rocky but will eventually offer a better balance between buyers and sellers and hopefully present homeownership opportunities for households that were excluded during the excessively competitive periods of 2021 and early 2022.

Nevertheless, many concerns remain about the housing market. Critically, while one of the biggest drivers of home price growth has been the lack of supply, higher rates are holding back both potential sellers and new construction. As such, there is no relief in sight for an improvement in housing supply and the sustainable housing market that would come with increased inventory.

© 2022 CoreLogic,Inc., All rights reserved.

griffithingre1998.blogspot.com

Source: https://www.corelogic.com/intelligence/reports/us-corelogic-sp-case-shiller-index-takes-another-step-back-in-july-up-15-8-versus-18-1-in-june/

0 Response to "Home Prices Continue Gains in April According to the Spcaseshiller Home Price Indices"

Post a Comment